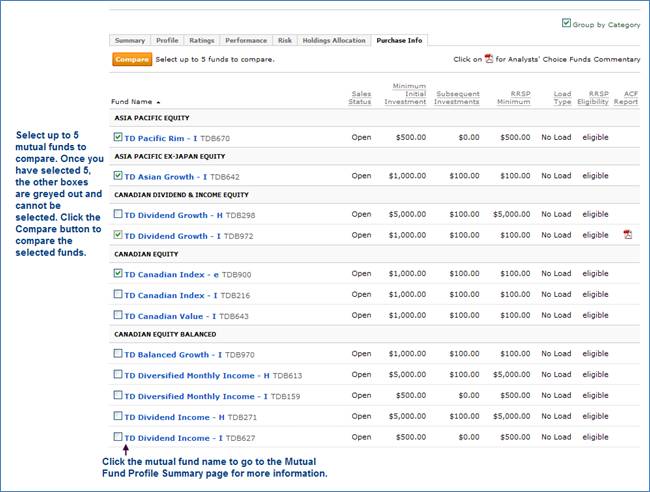

Purchase Info Tab

This section displays information about how to buy into a fund.

• Sales Status: Indicates whether the fund has open shares to purchase.

• Minimum Initial Investment: Indicates the amount needed as a minimum initial investment

• Subsequent Investments: Indicates the minimum amount needed to invest in additional shares of the fund.

• RRSP Minimum: Indicates the minimum amount needed for inclusion in a Registered Retirement Savings Plan (RRSP) account.

• Load Type: A mutual fund can come with a sales charge or commission. The fund investor pays the load. The load can be paid at the time of purchase (front-end load), when the shares are sold, (back-end load), or as long as the fund is held by the investor (level-load). If the fund has no charges, it has no load.

• RRSP Eligibility: Indicates whether the fund qualities for inclusion without limit in a Registered Retirement Savings Plan (RRSP) account. Certain funds using option strategies are qualified investments for RRSPs under the Canadian Income Tax Act.

Note: The minimum initial and subsequent investment amounts are defined by the Fund Company and can differ from TD Waterhouse’s minimum initial and subsequent investment amounts.