Analytics View

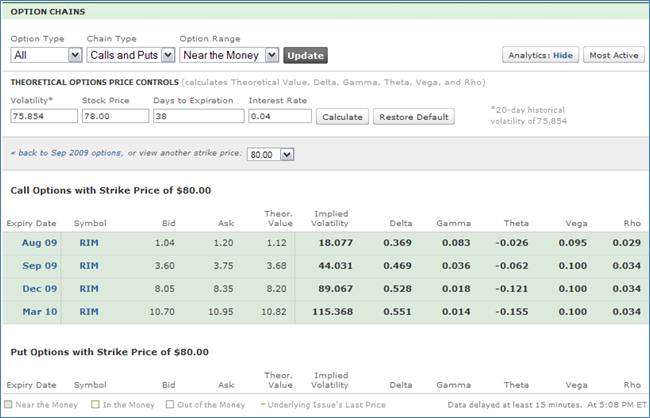

Click the Analytics button to open Option Analytics. The Theoretical Option Price Controls form is displayed with the following calculations displayed for your Option Chain based on the following default values:

• 20-Day Historic Volatility

• Volatility

• Stock Price

• Days until Expiry

• Interest Rate

You can use The Greeks option:

• Last Traded: Date on which the option was last traded.

• Expiration: The date on which the option expires.

• Theoretical Value:

• Implied Volatility: The volatility of the underlying stock built into the price of an option.

• Delta: The change in option price for a small change in underlying stock price assuming all of the other option pricing variables remain constant.

• Gamma: The rate of change of delta for a given change in the price of the underlying security.

• Theta: The rate of change in the price of an option for a small change in time to maturity.

• Vega: The change in price of an option for a small change (1%) in the level of implied volatility.

• Rho: The change in value of an option for a 1% change in value of the risk free interest rate.

You can enter your own values for:

• Volatility

• Stock Price

• Days Until Expiry

• Interest Rate

If you enter new values, click Calculate to recalculate the table based on the values you enter.

To return to the Option Chain table view, click Hide Analytics.

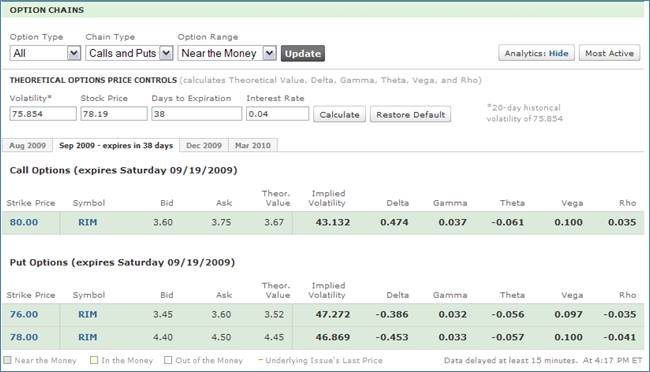

Click a strike price to see all call and put options for that price.