Non-Analytics View

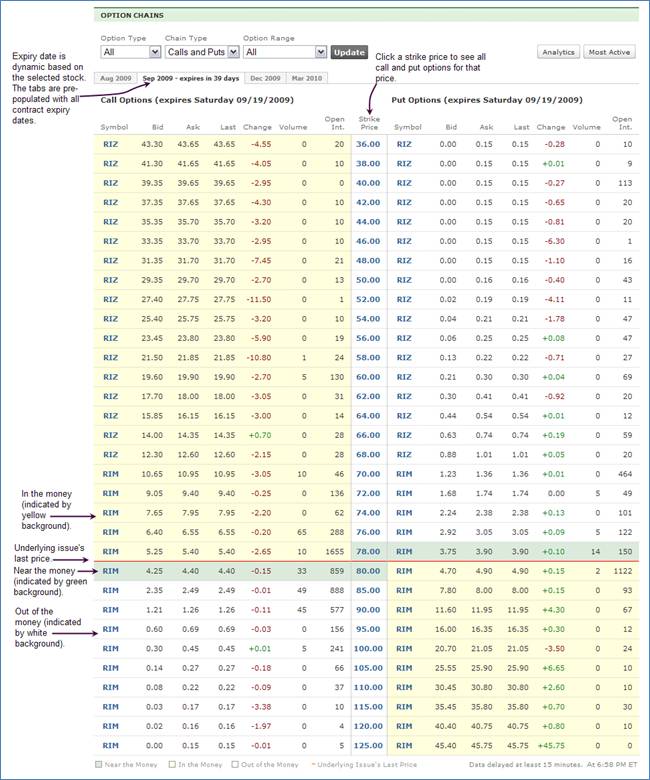

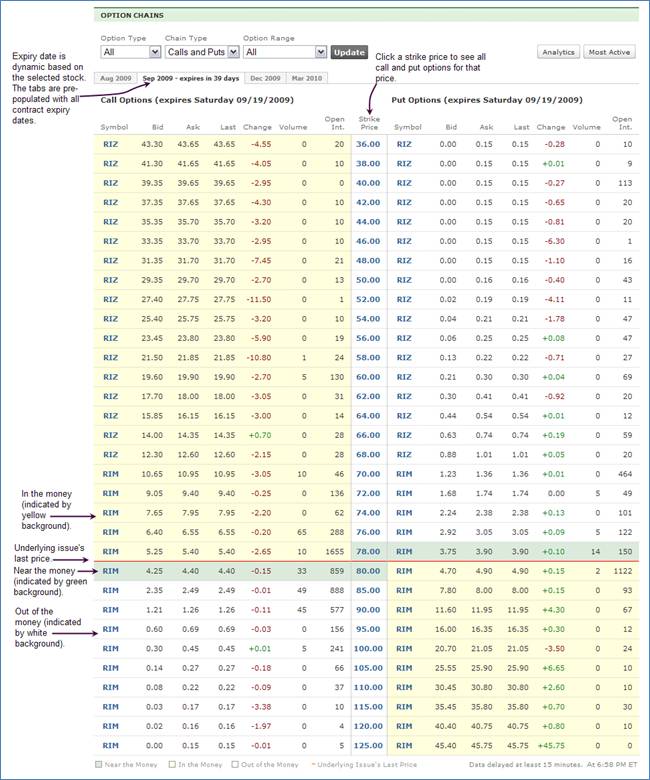

Click the strike price, for example, $48.00, to display all call and put options for that price.

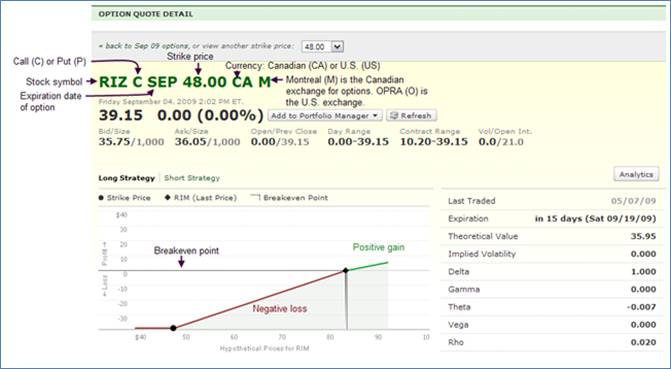

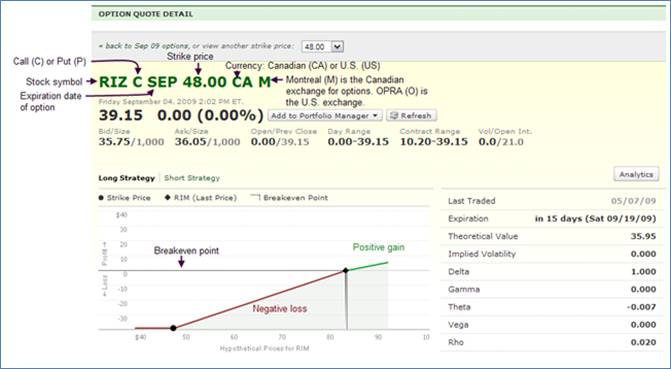

Click the symbol to display the Option Quote Detail screen.

Click the strike price, for example, $48.00, to display all call and put options for that price.

Click the symbol to display the Option Quote Detail screen.